🏢 Lease or Buy? How Texas Doctors Can Choose the Right Office Strategy for Their Practice

Why This Decision Matters

Your medical office is more than square footage; it’s the face of your brand, the setting for patient care, and one of your largest financial commitments.

Whether you’re opening your first clinic or evaluating space for a second location, deciding whether to lease or buy can shape your long-term stability, cash flow, and flexibility.

At STAT, we specialize in guiding healthcare professionals through these choices across Texas medical real estate. The best answer depends on your stage of growth, capital position, and how you envision your practice evolving over the next decade.

Estimated reading time: 6–7 minutes

The Case for Leasing: Flexibility and Focus

For new or rapidly growing practices, leasing often provides the clearest path to getting operational quickly while maintaining financial agility.

Flexibility to Grow or Pivot

Leasing allows you to adjust as patient demand changes. If you expand service lines, add providers, or outgrow your waiting room faster than expected, a lease term gives you options to relocate or upsize when renewal time comes.

In contrast, ownership can limit mobility if the property no longer fits your footprint or location goals.

Lower Up Front Commitment

Leasing usually requires less initial capital than purchasing. That can free up resources for clinical equipment, staffing, marketing, or technology.

Many landlords are willing to invest in tenant improvements (TI), which are modifications that make a space suitable for medical use, as part of a lease negotiation. Having a broker who understands healthcare build-outs can ensure those improvements meet compliance and workflow needs.

Simplified Operations

With a lease, the property owner typically manages exterior maintenance, building systems, and insurance on the structure. Physicians can concentrate on patient care instead of property management.

However, it’s essential to review the lease carefully for details on common-area maintenance, after-hours HVAC, and medical-specific clauses such as waste handling or compliance obligations.

STAT Perspective: Leasing can be a strategic first step. It allows a practice to establish its patient base and brand identity before deciding if ownership aligns with its long-term goals.

The Case for Buying: Control and Long-Term Value

Ownership can be a powerful way to create stability and build wealth, particularly for established practices with predictable cash flow.

Control Over Your Environment

Owning gives full authority over design and function. Physicians can tailor exam rooms, waiting areas, and treatment spaces to meet specific clinical needs without needing to negotiate each modification with a landlord.

That level of customization often translates to better efficiency, patient comfort, and staff satisfaction.

Predictable Costs Over Time

Mortgage payments are generally more stable than lease renewals, which may increase with market rates. Ownership can provide a sense of permanence, especially in high-demand areas where rent escalations are common.

Long-Term Investment Potential

Instead of paying rent indefinitely, ownership converts occupancy expense into equity over time. For many physicians, that equity becomes part of their retirement or succession planning.

Some practice owners choose to hold property in a separate entity and lease it back to the practice, a structure that can offer both liability protection and potential tax advantages. Always review such strategies with a qualified financial advisor or CPA.

Access to Specialized Financing

Healthcare professionals often qualify for lending programs designed for owner-occupied commercial properties. Government-backed and conventional lenders alike recognize the stability of medical tenants and may offer favorable terms compared to other small businesses.

STAT Perspective: For practices with a long-term presence in their community, ownership provides control, predictability, and a chance to turn a business expense into an appreciating asset.

Weighing the Key Factors

There’s no one-size-fits-all answer to leasing or buying. Each option carries trade-offs that depend on your goals, timeline, and tolerance for responsibility.

This quick framework highlights how the two paths generally compare for medical professionals:

| Factor | Leasing a Space | Buying a Property |

|---|---|---|

| Initial Cash Requirement | Lower up front; security deposit and limited improvements | Higher up front; down payment, closing costs, and potential build-out |

| Flexibility | Easier to relocate or expand at lease end | Less mobility; tied to property location and resale market |

| Control Over Space | Limited by landlord restrictions | Full control over design, branding, and long-term use |

| Maintenance Responsibility | Typically shared or handled by landlord | Fully owner’s responsibility |

| Predictability of Costs | Rent increases over time | Fixed-rate loans can stabilize payments |

| Tax & Equity Considerations | Rent is deductible; no asset growth | Mortgage interest and depreciation may be deductible; builds equity |

| Long-Term Wealth Building | No ownership equity | Potential appreciation and asset value at sale |

STAT Perspective:

Leasing often fits younger practices that need flexibility and want to preserve capital.

Buying tends to fit established practices confident in their patient base, location, and long-term footprint.

How Texas Market Conditions

Shape the Decision

Texas medical real estate dynamics vary dramatically between Texas’s major metros, suburban corridors, and rural regions. Understanding these distinctions helps physicians make location-smart decisions, not just financial ones.

Urban Texas Markets: Austin, Dallas–Fort Worth, Houston, San Antonio

The major metro areas remain highly competitive for medical space. Population growth and continued healthcare demand keep well-located buildings in short supply.

Leasing: In central city districts, leasing offers faster access to high-visibility spaces near hospitals, research centers, and referral networks. Many doctors choose to lease within medical office buildings or mixed-use developments to stay close to major health systems.

Buying: Ownership is possible but often limited to outer rings of these metros, where medical condominium projects and freestanding buildings are more common. Physicians considering ownership in city cores should plan for higher acquisition costs and longer development timelines.

Insight: In major metros, leasing is often the on-ramp to market entry; ownership typically comes once the practice is established and ready to invest in permanence.

Suburban Texas: The Growth Corridors

Suburban markets are expanding rapidly, driven by residential development and patient migration away from urban centers. Cities like New Braunfels, Boerne, Georgetown, Frisco, and Katy illustrate this trend.

Leasing: Suburban landlords are increasingly open to medical tenants, often offering customizable spaces in retail centers or new construction. Leasing provides flexibility as patient volume grows and demographics shift.

Buying: For many independent physicians, these markets offer the best balance of land and construction costs that are more manageable, and patient access remains strong. Medical condominium projects and small freestanding buildings are common entry points for first-time physician owners.

Insight: Suburban areas often represent the “sweet spot” with enough demand to sustain growth, enough space to own affordably, and fewer logistical hurdles than dense urban cores.

Rural Texas: Opportunity with Caution

Rural markets can provide both affordability and autonomy, but require careful planning.

Leasing: For practices testing a new area or satellite location, leasing minimizes risk and preserves the ability to exit if patient demand shifts.

Buying: Ownership can make sense in stable communities or where a practice is tied to a local hospital or critical access network. However, resale timelines can be longer and tenant replacement options limited.

Insight: Rural ownership can offer incredible value but works best for providers deeply rooted in their communities and confident in long-term patient need.

A Simple Framework for Making the Right Decision

Every physician’s situation is unique, but a clear framework can help you assess which path aligns with your goals.

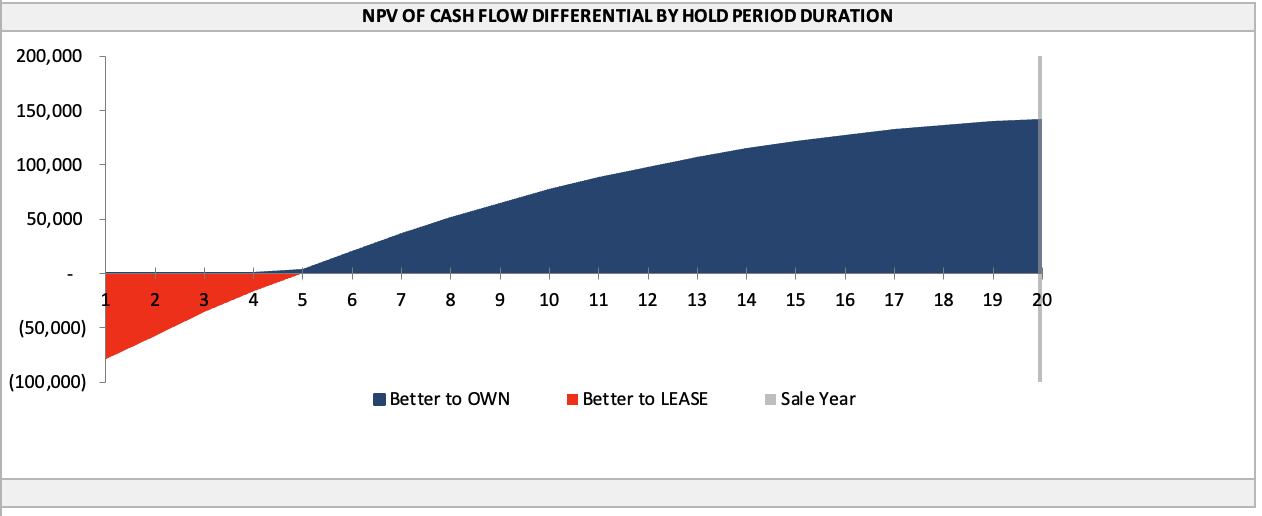

1. Consider Your Time Horizon

If you expect to stay in one location for less than seven years, for instance, while your practice grows or your referral network develops, leasing typically offers the flexibility you need.

If your practice is well-established and you plan to serve the same community for the long term, ownership can start to pay off financially and strategically.

2. Evaluate Your Capital Priorities

For newer practices, cash on hand often belongs in patient care and is not tied up in real estate.

If your priority is investing in people, technology, or new service lines, leasing preserves liquidity.

For stable practices with strong cash flow, shifting some investment toward property ownership can build wealth and long-term security.

3. Assess Operational Complexity

Leasing simplifies your day-to-day management responsibilities.

Buying introduces new considerations: maintenance, property taxes, and insurance that can add time or require additional staff or vendors.

Some physicians prefer to own but hire a property management firm to handle operations, striking a balance between control and convenience.

4. Think Strategically About Growth

If expansion is on your radar, like adding specialists, new modalities, or satellite locations, leasing may allow for faster movement across markets.

For practices aiming to consolidate and deepen their roots in a single community, ownership can strengthen your local presence and brand identity.

STAT Perspective:

The best strategy often evolves over time. Many of our clients start as tenants, then move into ownership once their practice stabilizes. Others blend both leasing in one market and buying in another to diversify their footprint and financial approach.

The STAT Perspective

Healthcare real estate isn’t just about square footage — it’s about aligning your physical environment with your mission of care.

At STAT, we specialize exclusively in healthcare properties, guiding physicians, dentists, and medical groups across Texas as they evaluate space, negotiate terms, and plan for growth. Our goal is to make the process simple and transparent so you can make confident decisions for your practice.

Because landlords and sellers typically cover brokerage fees, our advisory services come at no direct cost to you. That means you can lean on our experience, market insight, and healthcare-specific guidance without adding expense to your bottom line.

Whether you’re exploring a new lease, comparing ownership options, or planning an expansion, we’re here to help you make informed, strategic choices that position your practice for long-term success.

👉 Ready to talk through your options? Contact STAT to schedule a consultation or discuss current availability in your market.